EXCHANGE SUBSIDY APPEALS MAY REMAIN PAPER-BASED UNTIL 2017

Beginning in spring 2016, employers can expect to receive notices if any of their employees are deemed eligible for health insurance subsidies through an Exchange. Employers who receive these notices will have 90 days to file an appeal if they feel the eligibility determination was made in error.

Department of Health and Human Services (HHS) regulations require appeals to be accepted online, by phone, by mail and in person. However, guidance issued in March 2016, delayed (for the second time) the Exchanges’ deadline to implement electronic appeals processes.

Action Steps

Employers, especially applicable large employers (ALEs), should prepare to appeal any incorrect Exchange determinations. To prepare, employers should:

Become familiar with the appeals process; and

Maintain complete and accurate records regarding the health insurance coverage they offered to employees.

Background

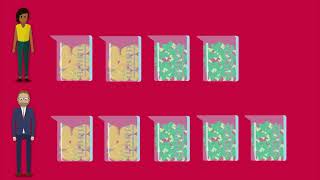

Under the ACA, ALEs may be subject to employer shared responsibility payments (also known as pay-or-play penalties) if they do not offer affordable, minimum value health coverage to their full-time employees. The Internal Revenue Service (IRS) will assess these penalties if a full-time employee receives subsidies to help pay for the cost of health insurance purchased in the Health Insurance Marketplace (Exchange).

An Exchange will determine whether an individual is eligible for these subsidies when he or she applies for coverage. This determination does not establish whether the individual’s employer is liable for shared responsibility penalties, but it may provide a basis for the IRS to assess penalties against an ALE.

For this reason, as well as to help ensure that individuals do not mistakenly receive health insurance subsidies, the ACA gives all employers the right to appeal Exchange eligibility determinations. An appeal will allow an employer to correct any inaccurate information the Exchange may have about the health coverage it offered to an employee who was deemed eligible for subsidies.

Appeals Guidance

On August 28, 2013, the Department of Health and Human Services (HHS) issued a final rule to establish the process for appealing Exchange eligibility determinations. The final rule outlined separate procedures for individual and employer appeals. Both processes require Exchanges (or a separate appeals entity or HHS, if applicable) to accept appeal requests from employers or individuals in any of the following ways:

By telephone

By mail

Via the internet

In person (if the entity is capable of in-person acceptance)

The final rule also requires Exchanges to transmit employee eligibility records through a secure electronic interface. However, to allow time for appeals entities to implement appropriate systems, HHS granted them the flexibility to use paper-based processes for the first year and then later extended the flexibility for another year. In the guidance from March 22, 2016, HHS extended that flexibility again, through Dec. 31, 2016. Therefore, employers and individuals may be required to file their appeals on paper only, until Jan. 1, 2017.

Earlier, in September 2015, HHS issued FAQs indicating that the Exchanges would start sending the first batches of employer notices regarding employee eligibility for subsidies in spring 2016.

Employer Appeals Process

Once an Exchange determines that an individual is eligible for subsidies, it must send notification to the individual’s employer. This notification must:

Identify the employee;

Indicate that the employee has been determined eligible for advance payments of the PTC;

Indicate that, if the employer has 50 or more full-time employees, the employer may be liable for the payment assessed under Section 4980H of the Code; and

Inform the employer of the right to appeal the determination.

f the employer wishes to appeal the determination, it must file an appeal request within 90 days from the date the notice was sent. Information on how to file an appeal request in the federally facilitated Exchanges, as well as some state-based Exchanges, is available at https://www.healthcare.gov/marketplace-appeals/employer-appeals/.

Exchanges and any other appeals entities must provide assistance if an employer asks for help with the filing. Employers may include evidence supporting their appeal along with the initial request, but they will have an opportunity to present this after filing the request as well.

When the Exchange or other appeals entity receives a request for appeal, it will send the employer an acknowledgment of the appeal and an explanation of the appeals process. If the entity determines that an appeal request is not valid, it must send written notification to the employer and include instructions for curing the defects. The entity will also send notice of an employer’s appeal and an explanation of the appeals process to the employee.

During the appeals process, the appeals entity must give the employer an opportunity to review the information the Exchange used to make the eligibility determination. This information will not include the employee’s tax return information.

An appeals entity must make, and send written notice of, an appeal decision within 90 days after the date it received the appeal request.

If the appeals decision affects the employee’s eligibility, the Exchange must promptly make a redetermination. Employees and their household members, if applicable, will have a right to appeal an Exchange redetermination that occurs as a result of an appeals decision.